MILLIONS of households are set for a rollercoaster with their energy bills this year.

We explain what’s going on, whether you should consider a repair, and how to fix it.

WHAT IS HAPPENING?

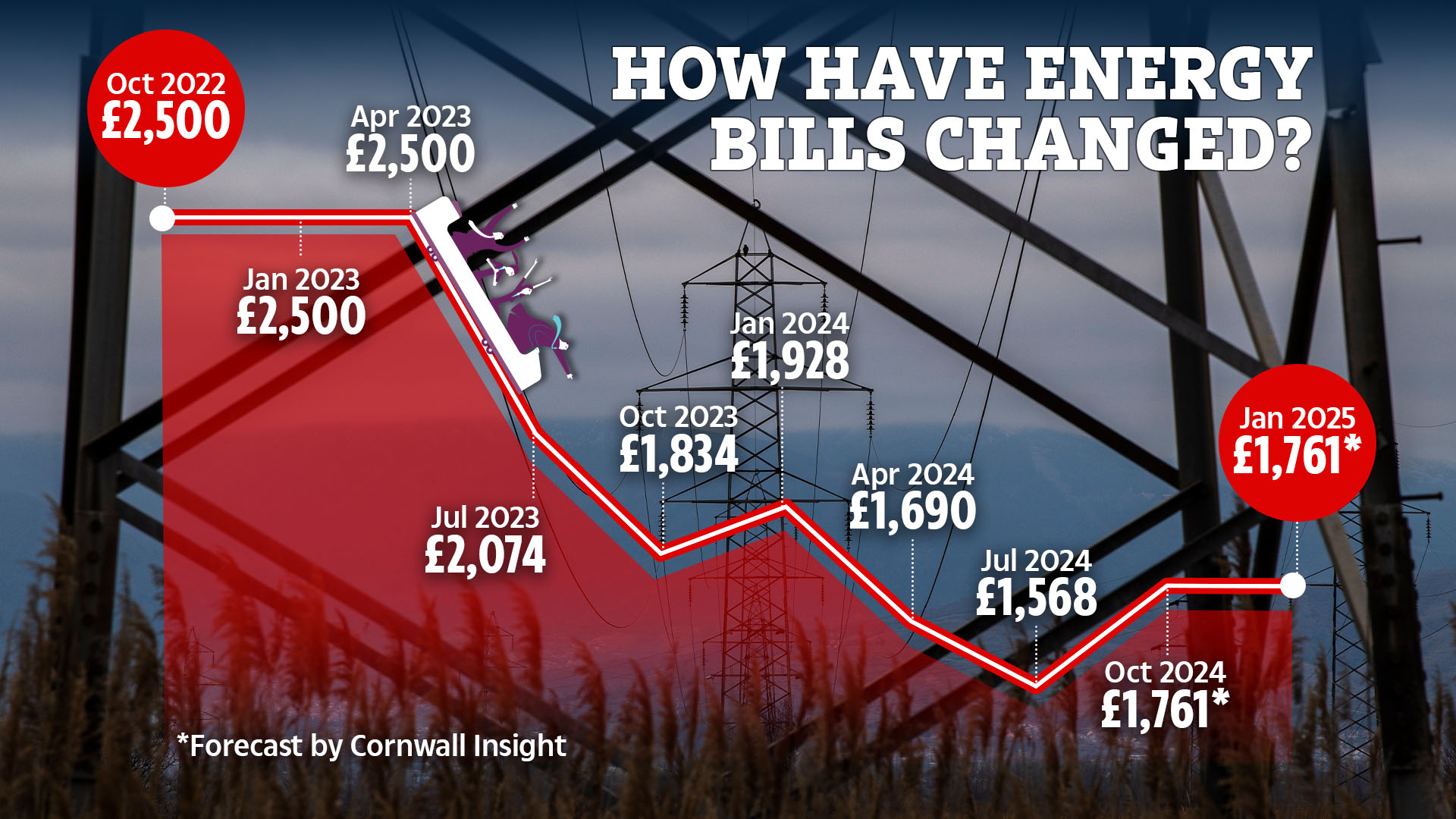

Over the past few years, energy bills have skyrocketed due to Covid quarantines, cold winters and geopolitical issues such as Russia’s invasion of Ukraine in early 2022.

An energy price cap limits the price you pay for energy, although your bill will vary depending on how much energy you use.

But households are set for some relief this summer when bills fall to their lowest level in two years, as the price cap, set by Ofgem, falls on July 1.

The typical cost for 29 million households on their energy supplier’s standard variable tariff will fall from £1,690 a year to £1,568 a year.

However, according to experts, this drop in costs will be short-lived.

This is because Ofgem reviews the price cap every three months.

And the latest forecasts from energy consultants at Cornwall Insight suggest typical bills will rise again to £1,761 in October.

Ben Gallizzi, energy expert at Uswitch.com, said: “Energy bills will fall in July as the price cap falls by 7%, providing some relief for households on a standard variable tariff.

“However, don’t be lulled into a false sense of security, as energy analysts suggest that rates will rise by 12% in October and remain so over the winter, increasing the average annual household bill from £200 to £1,761.”

So what can households do to manage costs? Let’s take a look at the options.

WOULD YOU FIX IT?

This is a question our readers ask us – but the answer is not simple.

Customers are offered two types of energy contracts – standard tariff and fixed.

The standard tariff is limited by a price cap.

But several major suppliers, including British Gas, Octopus and Ovo Energy, are now offering cheap fixed deals below the current price cap.

Fixing is good if you want security – but it’s a gamble because if prices end up falling, you could be forced to pay more.

Many have hefty exit fees of up to £190 that you have to pay to get out of them.

Buyers must also factor price cap predictions into their decision.

Ben Gallizzi, of uSwitch.com, added: “It’s impossible to know what energy prices will be in six, nine or 12 months’ time, but while prices continue to fluctuate, the best option for households looking to avoid payment uncertainty is to lock into a fixed contract that will give you at least a year of stability.”

James Longley, chief executive at Utility Bidder, said: “With Ofgem’s energy price cap set to drop in July, UK customers will be wondering if now is the right time to switch to a fixed energy contract.

“They give clients peace of mind and lots of choice in terms of start and end dates.

“It would be advisable to look and compare comparison sites to find the best deals for your energy repair, and this should only be considered if you’re locking in the lowest price.”

Kara Gammell, personal finance expert at MoneySuperMarket, added: “With speculation that the cap could rise in October, switching to a fixed tariff now can provide some reassurance if you want to know how much your energy will cost over the next 12 months.”

WHAT ARE THE BEST FIXED OFFERS?

There are several fixed bids that have exceeded the October ceiling price.

For example, Ecotricity currently offers its Green 1 Year Fixed tariff, which costs a typical household £1,540 a year – £150 less than Ofgem’s price cap.

That’s 2% less than July’s price cap (£1,568) but 12.5% cheaper than October’s predicted cap.

This comes with an exit fee of £75 per fuel – so £150 if you opt in with the dual fuel tariff.

While the Outfox the Market Fix’d Dual Jun24 v1.0 tariff will set a typical household back £1,576 a year – 0.5% more than the July price cap, but 10.5% more than the predicted October cap.

The Octopus Energy 12M Fixed tariff costs £1,611 a year, but there are no exit fees if you leave early.

For the average household, this will cost 2.5% more than the July price cap, but 8.5% below the October cap.

Be sure to compare prices before switching as they vary depending on where you live and consider exit fees.

However, customers need to be aware of other changes in the energy market that could affect prices.

TO FIX OR NOT TO FIX?

COMMENT from Tara Evans, Head of Consumer, The Sun: TO FIX or not to fix? That’s the question!

I really wish I had Mystic Meg’s Crystal Ball to help me answer this question.

As we explain in this article – there are many issues to consider.

I haven’t fixed my energy bills yet as I’m curious to see how changes in regulations and elections affect bills.

But whatever you decide, you need to compare prices and fees before making the switch.

ENERGY MOVEMENTS YOU HAVE TO WATCH OUT FOR

As with any good rollercoaster, there are some unexpected twists and turns to consider before making the switch.

Regulator Ofgem has revealed plans to lift the ban on acquisition-only tariffs later this year.

This would mean energy companies could offer low prices to new customers – but loyal ones would not have access.

The ban was an issue that Sun fought for, because it was ripping off loyal customers.

But now, experts think its removal could encourage fixed-rate contracts and restore competition to the energy market.

However, one energy company, Octopus Energy, told The Sun it would not offer cheaper tariffs, even if the ban is lifted.

The Sun will be keeping a close eye on how this affects prices and customers.

It would be good for the competition, but it means that the most sensitive could lose out.

Ofgem is also considering changing the way price caps work in the future.

This could include ‘dynamic’ price capping, which would mean energy companies could charge more at peak times and less at night, for example.

But those changes have not been agreed upon and there is no timeline yet for when they will happen.

HOW WILL THE ELECTIONS AFFECT BILLS?

Accounts could also be affected by the outcome of the election.

Labor wants to create a publicly owned energy company called Great British Energy, which it claims will cut household bills by £93bn.

The details remain unclear, and the party hasn’t really explained how this would lead to lower household bills.

The Conservative Party has yet to outline its ambitions to shake up the industry.

WHAT ABOUT FLEXIBLE TARIFFS

Users who do not want to repair can rely on the standard tariff that follows the price cap.

Kara Gammell, personal finance expert at comparison site Money Supermarket Group, says: “They will almost always be at or below the price cap.”

For example, E.ON Next’s Pledge variable tariff offers a fixed discount of around three per cent on the top price over 12 months.

This will save the average household around £50 a year, but comes with a £50 exit fee if you switch before the end of the year.

The offer is available to both new and existing customers.

For greater reward, but with greater risk, Octopus Energy offers two variable tariffs that track wholesale gas and electricity costs.

Customers on Octopus Tracker see their prices change daily, but unit prices have been consistently lower than the price ceiling over the past few months.

For example, in the last 30 days people living in the south of England on Octopus Tracker paid a maximum of 20.3 pence per kWh for electricity and 4.81 pence per kWh for gas, which is 4.2 pence and 1.23 pence cheaper than the above fuel price limits.

The Agile Octopus tariff works similarly to the Octopus Tracker, the main difference being that the first price changes every half hour.

But anyone wanting to switch to any of these tracking tariffs must have a smart meter.

What energy bill help is available?

THERE are several different ways to get help paying your energy bills if you’re struggling to get by.

If you fall into debt, you can always contact your supplier to see if they can put you on a repayment plan before they put you on the prepayment meter.

This involves paying off what you owe in installments over a period of time.

If the supplier offers you a repayment plan that you don’t think you can afford, talk to them again to see if you can negotiate a better deal.

Several energy companies offer grant schemes for customers struggling to meet their bills.

But eligibility criteria vary by supplier, and the amount you can get depends on your financial circumstances.

For example, British Gas or Scottish Gas customers struggling to pay their energy bills can receive grants worth up to £1,500.

British Gas also offers help through its British Gas Energy Trust and Individuals Family Fund.

You do not need to be a British Gas customer to apply for another fund.

EDF, E.ON, Octopus Energy and Scottish Power are also offering grants to struggling customers.

Thousands of vulnerable households miss out on additional help and protection because they are not registered in the Register of Priority Services (PSR).

The service helps support vulnerable households, such as those who are elderly or ill, and some of the benefits include receiving advance warnings about power cuts, free gas safety checks and extra support if you have a problem.

Contact your energy company to see if you can sign up.