- Crypto analyst Babenski predicted a possible 1000% jump for XRP.

- Despite optimistic forecasts, market indicators show mixed signals.

Ripple [XRP] has struggled to achieve significant growth in recent years.

While the asset has seen a modest gain of 9.1% year-to-date, it has also faced a minor setback, falling 1.7% over the past week.

This downtrend has continued into today, with a slight decline of 0.3%, bringing the current trading price to $0.52.

This constant price fluctuation has kept investors on guard as XRP continues to struggle with market volatility and significant regulatory challenges.

XRP’s long journey

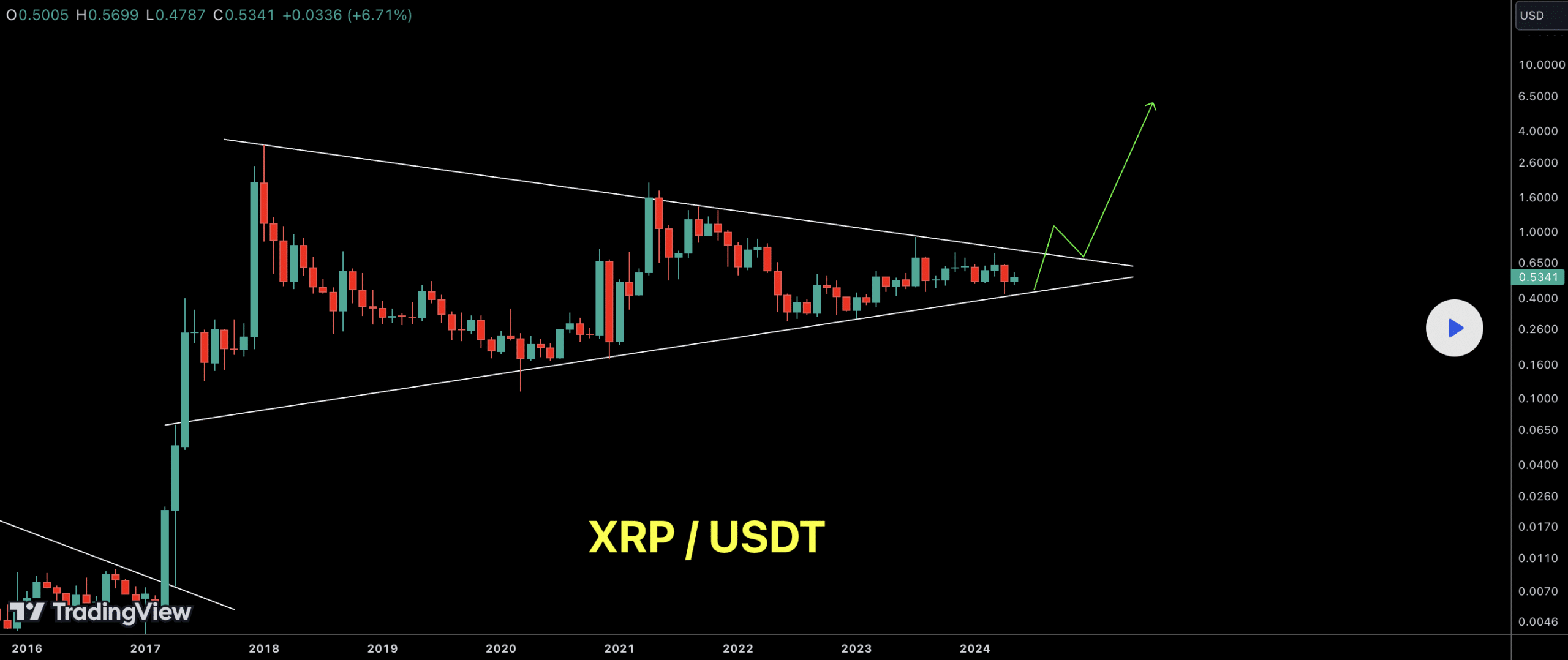

In 2017, XRP began what would become a protracted accumulation phase, initially fueled by a bull run. Many expected this phase to end in the next bull market in 2021.

However, the US Securities and Exchange Commission’s (SEC) lawsuit against Ripple in 2020 has seriously affected XRP’s price trajectory.

In doing so, it has crossed paths with other cryptocurrencies, which have seen significant gains over the same period.

Despite a partial victory in this legal battle in 2023, XRP failed to regain the $1 mark, continuing its trend within the accumulation range entering 2024.

Cryptoanalyst Babenski has brought new hope to XRP with a new analysis on TradingView, suggesting that XRP may finally be ready to emerge from its long-term accumulation phase.

Source: TradingView

Babenski’s predictions hinted at a potential breakout that could propel XRP’s price by more than 1,000%, potentially setting new all-time highs around $6.

This bullish forecast is based on technical patterns seen on the charts, which indicate a possible upward trajectory if key resistance levels are broken.

Could a breakthrough really happen?

However, a deeper study of market metrics paints a more complex picture.

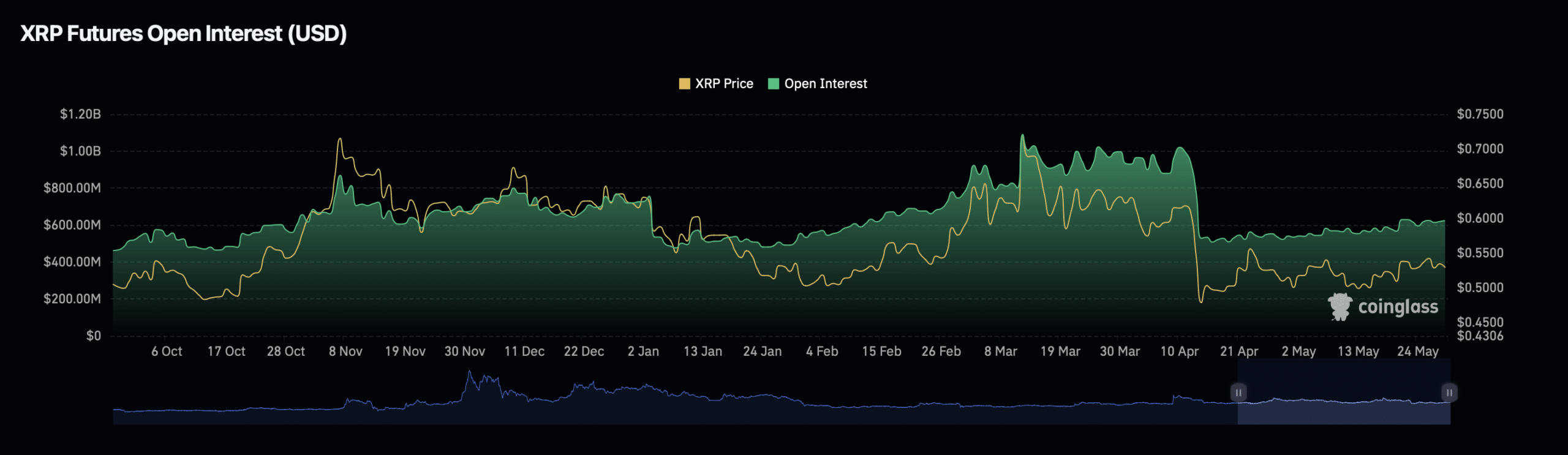

Current data on XRP open interest—which reflects the total number of outstanding derivatives contracts—shows a mixed signal of market sentiment.

According to Coinglassalthough there was an increase in open interest of 2.98% in the past day, there was a significant decrease of 21.32% over the same period in terms of open interest volume, totaling $737.73 million.

Source: Coinglass

This difference suggests that as more positions are opened, transaction volume declines, potentially indicating a holding pattern among traders waiting for the next market move.

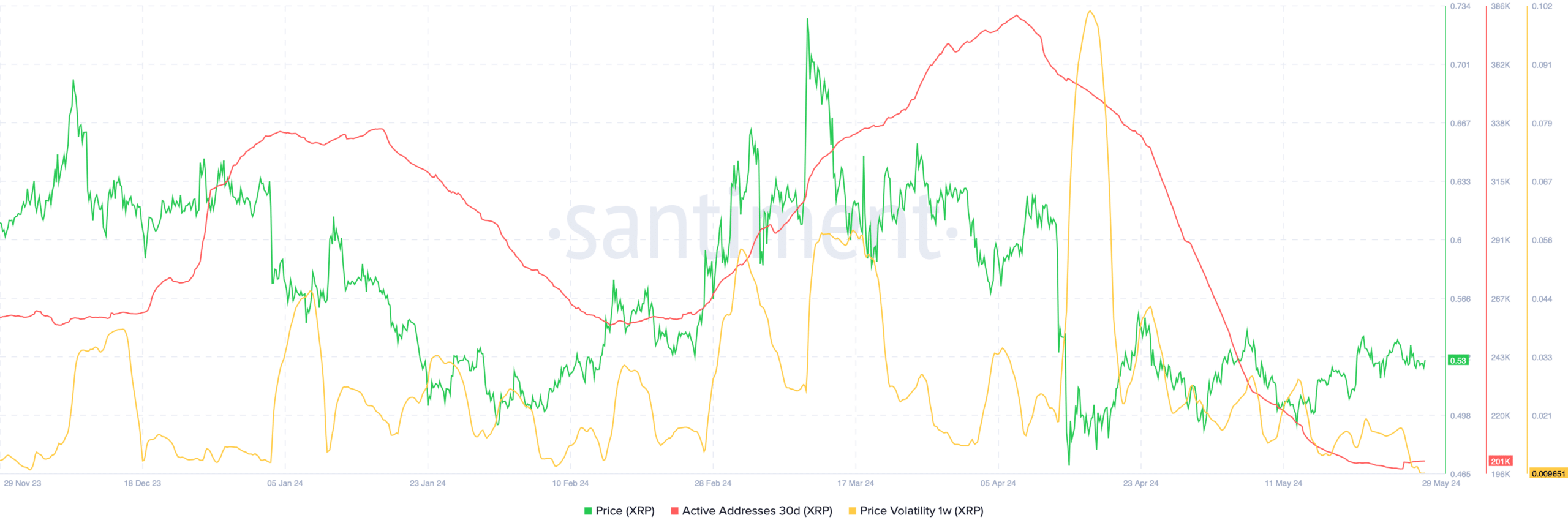

Furthermore, the AMBCrypto metric i Sentiment he emphasized the stagnation in market engagement.

Number of XRP owners remains static at 5.2 millionreflecting the lack of fresh accumulation despite fluctuating prices.

Additionally, a decrease in price volatility and active addresses indicates reduced trading activity and less engagement, suggesting that the market may be entering a consolidation phase.

Source: Sentiment

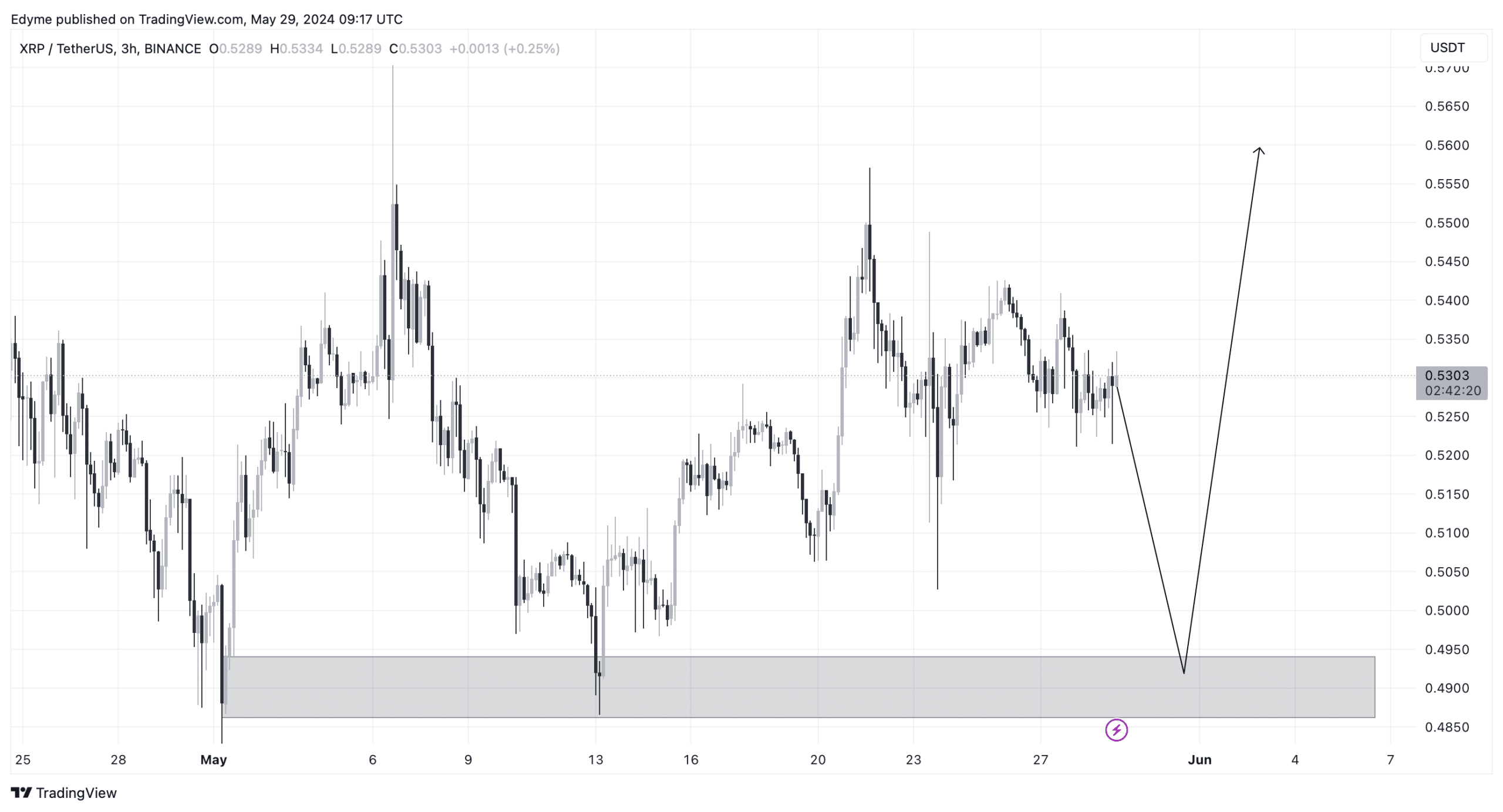

Technical analysis on the XRP chart has hinted at possible price movements and structural breaks to the upside for XRP.

Realistic or not, this is XRP’s market cap in BTC terms

However, investors and existing holders may still witness a drop to around $0.49, the level needed to accumulate enough market liquidity to fuel an upward bounce.

Source: TradingView

This nuanced understanding of XRP’s market position, aided by a blend of technical and on-chain analysis, provides a comprehensive view of what may lie ahead for XRP.